DeFi is an incredible use case in Web3. We’ve never had the ability to lend to or borrow from strangers without an intermediary like a bank. Yet, DeFi’s market cap ($60 billion) is a fraction of the total credit market which is estimated ($1.4 trillion). Real world use cases like lending to businesses, borrowing to buy a house or personal loans aren’t available on DeFi today.

In this essay, we’re going to look at why this is the case and offer some ideas for how we could overcome the obstacles.

DeFi vs. TradFi

Decentralised finance is the ability to connect savers and borrowers without an intermediary. In its purest form, logic is written into software and the system runs without intervention.

Consider a protocol like Aave, users can borrow against crypto collateral. There’s a loan-to-value ratio that is determined by a smart contract. If the value of your collateral falls and the loan-to-value ratio is breached, the collateral is liquidated automatically. The beauty of this system is that everything runs on autopilot and risk for lenders is minimised.

On the flip side, DeFi caters largely to the crypto native community. It serves users who’ve made their way into crypto and helps them borrow, lend or swap assets. Even for those who’ve made their way into crypto, it largely caters to users who have assets and can post this as collateral.

In the rest of this essay, we’re going to look at the gaps that need to be filled for DeFi to cater to non-crypto natives.

Types of lending

A quick detour to understand the types of lending.

Secured lending refers to lending against collateral. Mortgages are a great example. You borrow to buy a house, and if you don’t pay back the loan, the lender seizes the house. The same logic can be extended to businesses who can borrow against assets like land or machinery.

Unsecured lending refers to borrowing without collateral. Typically, the lender evaluates the risk of the borrower (e.g. using a credit score). The lender might ask for a personal guarantee — if they do, the director of the company is liable if the company defaults. In the last few years, there’s been a fair amount of innovation in the unsecured lending market. For example, companies like Pipe offer unsecured loans to SaaS businesses and take a cut of their revenue (often called revenue based financing).

Unsecured lending

The first step in unsecured lending is assessing the risk of the borrower. In traditional finance, companies like Experian or ClearScore provide this information. We’ll need this information on the blockchain so it’s openly and constantly accessible by any protocol. The challenge here is combining on-chain activity and off-chain activity. If you’re lending to a real business, most of the transaction history is not going to be in crypto. Protocols like ArcX, Cred Protocol and Rocifi are going after this.

Once you’ve assessed risk, you need infrastructure to facilitate the transfer of money. This part of the system is the most well developed. Protocols like Maple Finance, Goldfinch and TruFi are doing this already.

Finally, you need to consider what happens in the case of default. In traditional finance, when a borrower defaults, the lender has the following options:

If there is a personal guarantee, the lender uses the director’s assets to recover funds.

The lender may choose the renegotiate terms with the borrower.

The lender sells the loan to a different company, who then recovers the funds. These companies are called debt collection agencies.

The borrower declares bankruptcy and the money is gone.

With DeFi, this remains a pretty unexplored area. In my view it’s more of a legal question than a tech question. Personal guarantees don’t really seem like a viable option as DeFi aims to be permissionless. Renegotiating terms will work but fees like a stop gap. The main options on the table are selling the distressed debt to someone else, or writing it off.

Selling the distressed debt to someone else is possible. It’s really difficult to comment on any of this because of legal unknowns. For example, where does this debt sit vs. other debt that the borrower has taken on? Can this be enforced in the court of law?

Secured lending

Secured lending requires all of the above and more. Because you’re lending against an asset, that asset needs to be “on-chain”. Consider a real-world asset like your house. For starters, there’s no ability for someone to constantly monitor the price of your house. In addition, there’s no way to verify that you actually own the house. Compare this to a wallet that owns 1 BTC, it is possible with code to verify that you own that 1 BTC and the value of the BTC.

This is really tricky and not because of technology. It’s tricky because these assets are illiquid. Generally speaking, the more often an asset is sold the easier it is to have a constant price feed. This is simply not possible with something like a house. A constant ownership feed is simpler — if ownership was recorded using an NFT and this was legally recognised (this is a big if), you have a constant ownership feed.

In addition, the case of default is slightly different. In traditional finance, when the borrower defaults, the underlying collateral is sold and money is recovered. How does this work in a decentralised setting? Someone needs to do the work of selling the house and recovering the funds.

I see two potential options to solve this. The easy route is outsourcing. The protocol sells the debt along with the collateral to someone else. They are responsible for selling the asset and recovering the funds. They earn a fee for doing this — usually by buying over the debt for a discount.

The harder route is for the protocol to try selling the asset. Typically, DeFi protocols have a DAO (decentralised autonomous organisation). It’s a community of people who participate in the protocol and vote on major decisions. For example, here’s the governance forum for Aave. DAOs have sub-committees who are responsible for different matters.

You could imagine a sub-committee that is specifically in charge of selling collateral and recovering money. This is easy on paper but has its share of challenges. For starters, DeFi is borderless but real world collateral is not. If the house you’ve lent against is in the Cayman Islands, you need someone to take over that house and sell it, i.e. you need someone in the Cayman Islands.

There are also legal questions. Can a DAO own physical assets? What happens if the house that you’ve lent against cannot be sold?

To close

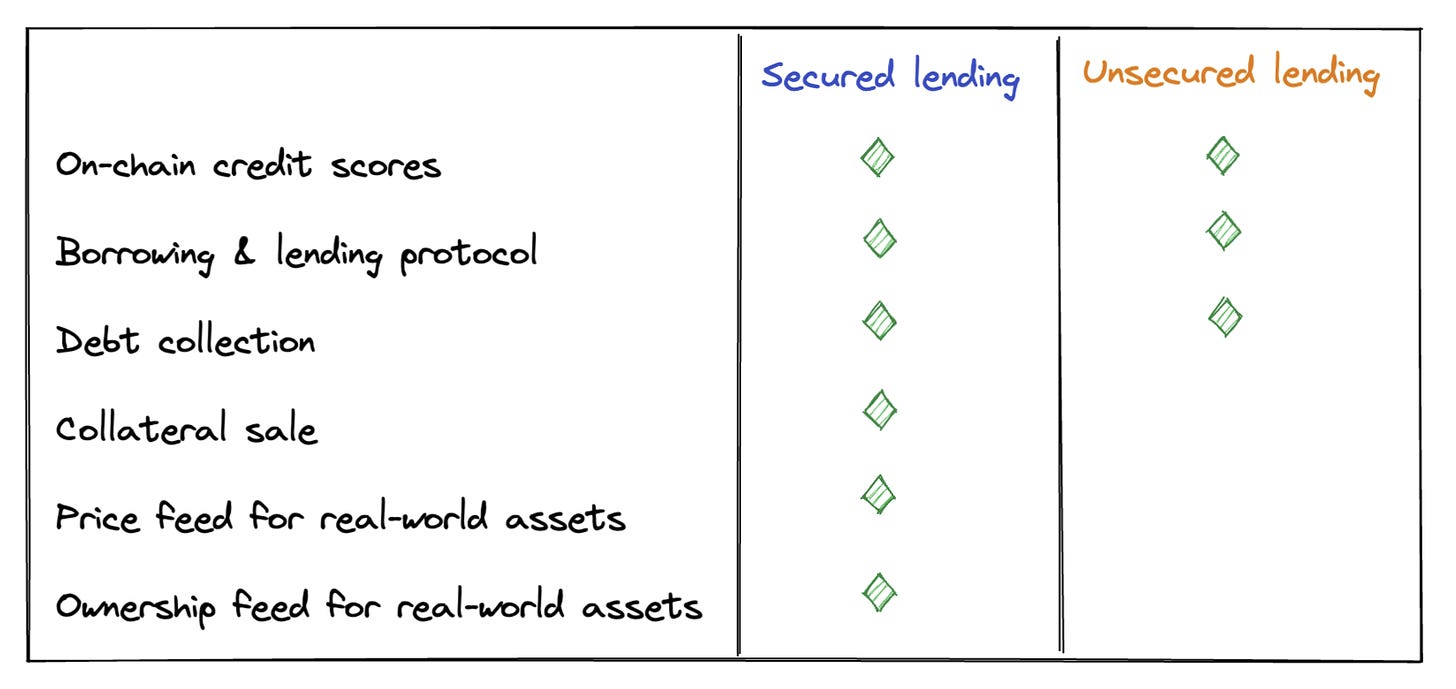

This essay hits different from others that I’ve written previously because there are SO many unknowns. Every blank in this essay is simultaneously one of the most challenging and rewarding things one could build in DeFi today. All of this needs to be happen for DeFi to meet TradFi and scale. Here’s a visual summary:

If you’re building any of the above, I’d love to talk to you. Shoot me a message on Twitter.