In this week’s deep-dive, I’m going to walk you through why the time for DeFi is now.

Approximately, $2 trillion in market cap has been wiped from crypto in recent weeks. I believe the time for DeFi is now because of this.

Here’s why.

2008: Great recession

Here’s a rapid fire reminder of how and why the 2008 recession happened:

Borrowing was excessive. People were able to get housing loans with little collateral.

Debt was piled on debt. Bankers created derivative products on top of these home loans and sold them (often called mortgage backed securities). For reference, U.S. home mortgage debt relative to GDP increased from an average of 46% during the 1990s to 73% during 2008.

House prices collapsed. Houses were the underlying asset for the loans. When the economy slowed, house prices collapsed and people were unable to pay their mortgages. The collateral - houses - was seized, but it wasn’t enough to repay lenders.

Chain reaction sets off. The lenders, the biggest financial institutions in the world, were also borrowers in other areas. Because they couldn’t get their funds back, they couldn’t pay the people they borrowed money from. The death spiral begins.

This is an over-simplification, but it’ll do for the point I’m about to make.

CeFi collapse = crypto’s 2008 moment

Last week, I wrote about the curse of leverage. The story in crypto isn’t very different from the 2008 crisis.

Companies like 3AC borrowed from other companies like Celsius. Protocols like Terra, which promised unrealistic returns, collapsed and 3AC lost large sums of money. The price of crypto assets tanked, which meant that 3AC could not pay back their loans even if they liquidated collateral.

Whilst the details might differ, the principal remains the same. This is crypto’s 2008 moment. In 2011, the US congress identified the following reasons, amongst others, for the 2008 crisis:

"widespread failures in financial regulation and supervision", including the Federal Reserve's failure to stem the tide of Toxic assets;

"dramatic failures of corporate governance and risk management at many systemically important financial institutions" including too many financial firms acting recklessly and taking on too much risk;

"a combination of excessive borrowing, risky investments, and lack of transparency" by financial institutions and by households that put the financial system on a collision course with crisis;

These seem very applicable to the likes of 3AC and Celsius.

Why is DeFi better?

DeFi is a better alternative than CeFi because of transparency and custody.

We’re going to use Compound, a DeFi protocol, as an example as we go through this. Compound allows you to do two things:

Borrow crypto using collateral

Lend crypto to earn interest

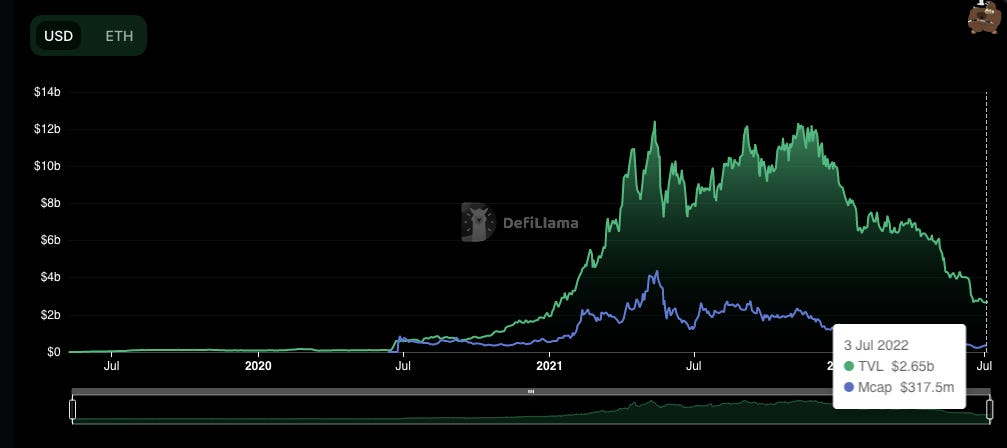

At the time of writing, Compound had a market cap of $317 million and total value locked (TVL) of $2.65 billion.

Better borrowing & lending rates

A DeFi protocol can offer better borrowing and lending rates.

The business model for financial institutions is simple:

Borrow from X

Lend to or invest in Y

Any difference (i.e. Y - X) is profit after subtracting all other costs: real-estate, staff etc etc. There is lots of nuance and complexity of course, but the basic premise remains the same.

At a high-level, the premise of DeFi is to do the above without intermediaries. Unlike a bank who acts as an intermediary, DeFi protocols do this peer-to-peer using blockchains. As a result, they save on costs that traditional financial institutions would incur. For example, a traditional bank will need a team of people to chase borrowers to pay their loans. A decentralised protocol does not need this. Any savings in cost can be passed on to customers of the DeFi protocol.

I want to reiterate that we are not there yet. Even if the rates on DeFi are attractive, other factors like the extent of collateral needs to be taken into account. This is simply to point out that DeFi has a valid, credible hypothesis for why it might make the world of finance more efficient.

Transparency

DeFi offers complete transparency for anyone who is willing to look.

Every single transaction on Compound is on the blockchain. Check out this dashboard on Compound (courtesy of Messari crypto, an indepdent crypto research firm). The graph below shows outstanding deposits and loans on the Compound protocol.

This means that anyone lending to or borrowing from a DeFi protocol has the ability to review data on a real-time basis before making a decision.

Traditional Finance does not provide this level of transparency. CeFi platforms may claim to do so, but they are simply not as transparent as DeFi. The proof is in the pudding — no one can really say with 100% certainty who 3AC or Celsius borrowed from or lent to.

Machine beats human

DeFi protocols use software to manage risk, which is superior to humans for this specific use case.

The entire Finance industry, traditional or crypto, is an interconnected web. Everyone is lending to someone and borrowing from someone else.

Shit hits the fan when someone defaults and fails to pay. With DeFi, smart contracts manage this without human intervention. Let’s use an example from Compound.

I own 10 ETH and want to borrow against it.

On Compound, ETH has an 82% collateral factor. This means that with 10ETH I can borrow a maximum value of 8.2ETH (in whatever crypto currency I want).

If the price of ETH falls enough such that my collateral is worth less than 8.2 ETH, my collateral is liquidated.

A DeFi platform uses a smart contract to execute the above. This means that no single individual or group of individuals, needs to act for (3) to take place.

CeFi operates differently because:

Liquidating positions is controlled by humans.

I believe that the DeFi model is superior because it contains risk. In a world where everything is linked, it’s better for one persons position to be liquidated vs. bringing the entire network down.

Custody is king

DeFi protocols allow users to retain custody of their assets.

With traditional finance or centralised finance, you delegate custody to a bank (traditional finance) or a company (CeFi). This means they have the power to freeze withdrawals.

This happened when Celsius crashed. But most folks have forgotten that it also happened in 2008, when banks crashed. The picture below is from Brighton in 2008 - when customers queued up to get their money out of Northern Rock.

In 2008, the government stepped in and rescued the banks. So my question is the following: if I’m delegating custody to someone, why wouldn’t I do it with a bank? In the UK, £85K worth of deposits are guaranteed as part of the FSCS scheme.

With DeFi, you always have custody. This means you can cut your losses whenever you choose to. Better safe than sorry in my opinion.

How we get there

DeFi hasn’t lived up to its potential yet. It’s still very early. My view is that it needs to improve on the below in order to get there:

Self-custody

Today, users have to choose between self-custody or a better user experience.

Most users don’t want to deal with seed phrases or operate multiple wallets. We need products that let users custody assets themselves with an excellent user experience. I’ve written about this here, including companies that are building solutions in this area.

Better information

We need better information on DeFi protocols for mainstream users.

Transparency is great but most users don’t have the time or the know how to process the information. This is true for traditional finance as well. Agencies like Moody’s have built their business on providing credit ratings to businesses.

We need a decentralised version for DeFi. Mainstream users should be able to review clear, coherent information on all risks associated with a protocol.

Business finance

DeFi will truly scale when businesses borrow and lend off of it.

For volume to truly scale, we need businesses leveraging DeFi. We’re pretty far away from this. It’s not because DeFi isn’t ready for it. It’s because businesses are not ready to own crypto. The volatility (though you can mitigate with stable coins), regulatory environment and potentially higher tax liabilities are not worth it.

To close

The premise of DeFi over traditional finance is better rates for borrowing and lending. CeFi’s objective was to offer the best of both: a better user experience, and rates that match DeFi. Unfortunately though, CeFi requires users to trust the custodians who manage their assets. And in a risky asset class like crypto with little to no regulation (yet), a computer will make better decisions when it comes to borrowing and lending money.