Scaling DeFi

This needs to happen for DeFi to 10x

The total value locked in DeFi today is $82 billion. I believe it has the potential to increase the efficiency of financial markets and make them more equitable. But it’s going to take a while to get there.

In this deep-dive, we’re going to look at what needs to happen for DeFi to 10X.

Why DeFi?

I wrote about why the time for DeFi is now. From a user perspective, DeFi excites me because of the following reasons:

It removes intermediaries. As a result, you can borrow money at lower rates and lend money to earn a higher yield.

Risk is managed using code. Lending happens through logic — when a position falls below a pre-determined amount, collateral is liquidated. This brings down a single entity and prevents contagion.

Reduces lead times. Getting a loan or depositing money via DeFi is faster than going via the TradFi route.

It is equitable. A DeFi protocol doesn’t know or care about who you are. It lends you money based on the assets you have. It does not judge based on gender, religion, race or colour.

How people borrow money

The ability to lend and borrow money is critical to an economy. It connects the resource rich with the resource poor.

If you want to start a coffee shop, a coffee machine is going to cost you a couple of grand. Without the ability to borrow, you can’t get the business off the ground.

According to the World Bank, 53% of adults borrowed money in 2021.

Formal borrowing is higher in developed economies vs. developing economies. Interestingly, it’s not that developing countries don’t borrow at all; they just borrow using “informal” methods. This might be a loan from a friend or a family member.

Lending can also be classified into:

Secured / collateralised loans: the loan is secured with an underlying asset. You take out a loan to buy a house. If you don’t repay your load on time, the lender seizes your house. Your house is the collateral.

Unsecured / un-collateralised loans: these loans have no underlying asset. Credit cards are the best example. You can borrow money using your credit card. If you don’t pay your bills repeatedly, the credit card company will try to recover funds via a debt collection agency. There’s no underlying asset they can sell to recover your funds.

Borrowing and lending via DeFi

Nearly all the lending in crypto happens via collateralised loans. Here’s a real world example from Aave, a DeFi protocol, to illustrate how DeFi works:

Supply collateral

I supplied ~$500 Ethereum as collateral. If I do nothing, I earn a 0.96% return on my Ethereum on an annual basis.

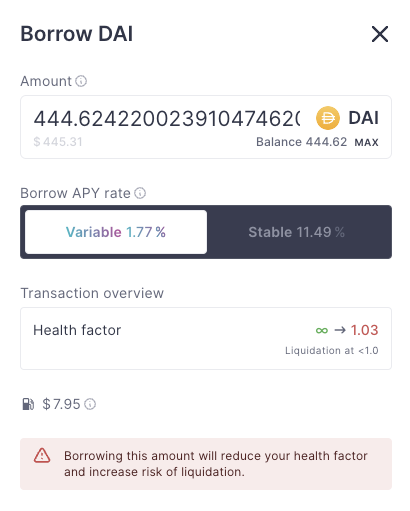

Borrow

Using my Ethereum as collateral, I can borrow other cryptocurrencies. Let’s use DAI as an example. DAI is a USD stablecoin — meaning that it maintains a 1:1 peg with the US dollar.

I can borrow at a variable (1.77%) or fixed (11.49%) rate.

The maximum amount I can borrow is $444. DeFi protocols over-collateralise due to the volatility of cryptocurrencies (in my case, Ethereum). In my case, I can borrow a maximum of 89% of my collateral. At this level, Aave is warning me that my position is at the risk of liquidation.

Taking DeFi mainstream

Today, DeFi facilitates borrowing and lending only between crypto users. This ceiling needs to break for DeFi to explode.

The only real world asset I can borrow against are a handful of currencies. Here’s the flow:

I have $1 million dollars in my bank account.

I exchange the $1 million dollars for a stablecoin, e.g. DAI.

I use the DAI as collateral to borrow whatever I like.

The problem though is that the people who really want to borrow don’t have money lying around. They want an injection of capital to buy a house, start a business or send someone to college.

To scale, DeFi needs to let people borrow against their real-world assets or using their reputation.

Collateralised lending with real world assets

Users should be able to borrow on DeFi using real world assets like collateral. To do so, we need to solve:

Illiquidity of house prices: house prices are not like Ethereum or Bitcoin. What happens if the price of the house falls substantially but the protocol you have borrowed on doesn’t know that yet? Given the need for decentralisation, you will also need to ensure there is consensus around price and it doesn’t come from a single party.

Seizure of assets: let’s say the borrower fails to pay the loan, what happens to the house? In traditional finance, a bank will seize your house. Who seizes the house with DeFi? One option is to have the house transferred to the DeFi’s protocol’s DAO (decentralised autonomous organisation). The DAO sells the house and recovers the funds.

Notable examples:

Centrifuge: attempting to bring real world assets on chain.

RWAmarket: real-world assets on the blockchain.

No protocol has really nailed this, despite trying since 2018. This is a legal and regulatory issue, not a technology one.

Un-collateralised lending using reputation

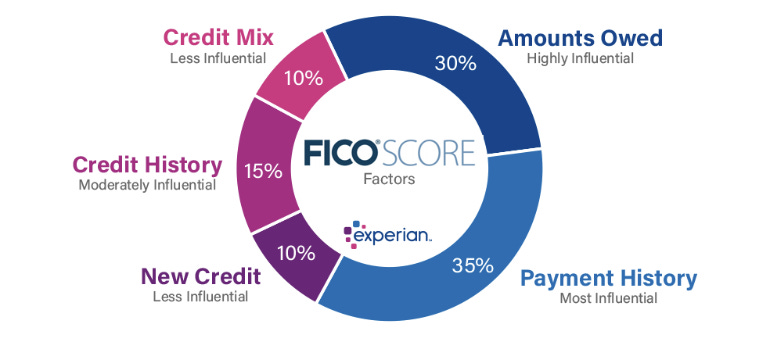

In traditional finance, you can borrow using your credit card. Credit cards lends you money based on your credit score. Experian, a credit score company, lists the following as inputs for your credit score.

The issue with reputation is that you need to know everything about a person. In a world where most transactions happen offline, you need that data.

Notable examples of companies in this area:

TruFi is going after this for institutions. The DAO manually approves institutions who are credit worthy.

LedgerScore is building a credit score for individuals and companies that considers real-world and crypto assets.

The primary challenge I see with unsecured lending is seizure. What happens if someone who borrows against their reputation can’t pay the loan? Loans have to be tied to an individual. Otherwise, I can take a loan out today, default and then take another loan tomorrow using a different wallet.

To close

Today, DeFi only caters to people who can provide crypto as collateral. For it to scale, it needs to cater to people who really need the money. Typically, these people don’t have crypto.

There are two ways to solve this. First, the ability to use DeFi with real world assets like a house. Second, the ability to borrow without collateral using your credit score. Solving this is challenging, but that shouldn’t stop people from trying. The opportunity on the table is huge.

If you or anyone you know is working on the above, I’d love to chat with you.

I am excited about the SBTs for this same reason.

Feels like SBTs will allow credentials to be put on-chain which will in fact allow credit agencies to create credit ratings from those credentials leading to unsecured loans.